Different Moms Are Using Search To Solve Problems

Moms have different versions of themselves every day, different needs every hour, they are using search to find answers, we need to understand their profiles and be everywhere our mom wants to be. Provided below is a list of 10 mom profiles

1. Pregnant Mom - what do i need to know when becoming a mom?

2. Meal time Mom - How to cook for kids?

3. Doctor Mom - his got a fever what can i do?

4. Cleaning Mom - what are safe cleaning products?

5. Tech Mom - what gadgets can improve our family

6. Education Mom - how can i give my child a head start?

7. Health Mom - what health & nutrition does my family need?

8. Social Mom - how can i connect and share with other moms and friends?

9. Beauty Mom - how do i look and feel beautiful?

10. Wife Mom - what does my family need most?

These 10 versions of moms 10 common questions they seek and answer everyday. Knowing this as marketers we have to provide options for her, its about her needs not ours.

How To Advertise For Moms Online In Under 1 hour

In the steps below i wanted to create an example company, so you can better understand the process to advertise for moms online.

Industry: Bedding Retailer

Product: Beds, Mattress, Bedroom Furniture

Research & Analysis Phase

1. Undersand what types of mom would buy our products? In this example beds and mattress category would evoke the Pregnant, Health & Wife Mom. 3 mom types

2. Understand what are the key drivers to buying a bed for a mom, what are they questions they ask themselves?

- Pregnant Mom - We have an old mattress, im starting a family do i need a new bed?

- Health/Nutrion Mom - What is the best bed for my sore back?

- Wife Mom - Will my husband and i be able to sleep when we get up at night regularly?

3. Where are they going to seek answers?

- Preliminary search is done through search engines. The question is asked

- Search engines than provide results - consisting of blogs, community portals, retailer websites. Many answers are provided and moms are now educated

- Social networks groups - moms ask friends, other mothers or experts on social network groups about the question, and deliberates answers. Moms are looking for recommendations, reviews and feedback on products to help resolve the question

Planning & Communicating

4. Identify the right products to solve the need.

We know what the questions are;

- We have an old mattress, im starting a family do i need a new bed?

- What is the best bed for my sore back?

- Will my husband and i be able to sleep when we get up at night regularly?

Do we have a product that answers those problems? In this example

- we have a mattress that is made for users with a bad back

- a product with minimal partner disturbance

5. Develop the marketing communication & unique selling proposition

- We are marketing to the 21st century mom, we need to understand the voice of modern motherhood. Actively listen to the community, understand the hearts and minds of all the drivers, motivations, insights, her journey through motherhood. Having a baby triggers a series of purchases, and all these factors will affect the purchase.

- Market our bed as mom endorsed. Create a digital badge that instills credibility in the product from recognised moms from all around the world. Take advantage of the digital age.

- Communicate the need that when becoming a mom buying a new bed is just as important to you as it is to your child.

6. Select to Advertise On The Networks our Moms Are In

We have identified that moms use search to solve problems, seek answers from blog and community websites, use social networks to create dialogue and aim to seek a recommendation from a past user, friend or fellow mom.

- Which search engine are they seeking answers on? Does this differ from country to country and ethnicities? Is Google better in the states whereas yahoo is better in asia?

- Which blog sites are providing answers? In this example just be the mom and ask google a question and see what sites your being directed to.

- Which social networks are they seeking answers? Facebook, Twitter, Youtube.

Execution, Participation & Delivery

7. Agile Marketing - Innovate, Be Flexible Define Resources Based On Outcomes

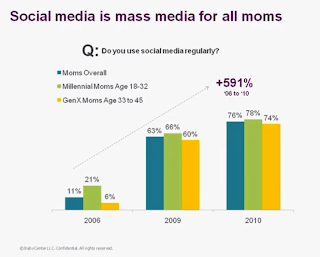

We know online search and social networking plays a big role, we need to identify how to participate in the social network without over retailing ourselves. Since 5 years ago there has been a 5 fold increase in mom users on social networks. There is no singular silver bullet technique to crack the social network game, however putting the needs of the moms first gives us a better chance on social networks.

This customer is now moving into a new segment, they are actively searching for answers thus being more receptive to your communications. This transformation from prospect A to prospect Mom opens up your ability to create a new customer for life. They are in a need state now and you need to build a strong relationship with them through the tools that they are using.

- Advertise on Google search for question, product, needs based keywords. Long & Short tail

- Setup ads to run when moms are online

- Setup Google display advertising on relevant themed websites

- Setup banner ads on relevant community & blog related websites

- Participate and answer questions as your brand on these websites however dont sell!!!

- Setup Facebook ads based on mom profiles & advertise your Facebok page

- Engage with popular youtube review videos and contact user to review your product

- Create an online video that encapsulates the needs of moms & your product. Again dont sell provide helpful contextual advice.

- Use social networks to educate and help them find answers, be neutral and offer honest opinions.

- Create a social competition that encourages moms to be moms

To conclude,

Its 1990, your a toddler again, age 3 to be exact. You sit in your baby chair happily eating that pureed sweet potato, watching mum as she works. Mum is watching that infomercial channel again, she's on the phone to her sister complaining about her car whilst organising her banking, you spill that pureed sweet potato all over the floor, she pauses her conversation, gives you that naughty look and wipes it up and continues.

Its 1990, your a toddler again, age 3 to be exact. You sit in your baby chair happily eating that pureed sweet potato, watching mum as she works. Mum is watching that infomercial channel again, she's on the phone to her sister complaining about her car whilst organising her banking, you spill that pureed sweet potato all over the floor, she pauses her conversation, gives you that naughty look and wipes it up and continues.

Fast forward 20 years and we are in the exact same scenario, only this time instead of the phone, shes on her laptop chatting to her sister on Facebook.com, researching buying a new family car on carsales.com furiously commenting on a thread in babycenter.com and doing her banking at scotia.com, oh and occasionally making sure you dont spill that sweet potato puree.

2011 Mom Online Search Behaviour

Thanks to OTX research, Google & Baby Center we have some profound statistics on moms.

- A new mom is born every 7 seconds

- Search doubles when a women become a mom

- Mums are the decision makers

- 3 in 4 moms feel like they have gotten better at searching

- Moms have become so good at search that more than 1/3 of them don’t even scroll down the page

- Modern moms are determined to find the best deals

- After searching for a product online 55% of them purchase in store

- More than 2 in 3 mum considers search their back up brains